Happy New Year! I can’t believe we are in a new decade, that is crazy! To kick off the new year I like to write an inspiring post about creating the best you possible. I’ve shared my traditional for yearly goals and my favorite self-care tips in years past. And this year I’m sharing a financial wellness post to get you into gear.

This time of year is for reflecting on the past year and making any adjustments you want in your life. I know for me the end of the year is all about spending money. From gifts to dinners, my wallet is bleeding money this time of year. Then add in the after Christmas sales I love to shop and it’s just pure madness.

The key to being able to take the bleeding wallet this time of year is to be prepared for it. For many years I knew it was coming, but was never prepared for it. I figured I would catch up in the new year. Even now, I’m not fully prepared for it. I end up cringing a bit when the credit card bill arrives. However, this year it’s hitting me a little softer because I was prepared mentally and in my bank account as well.

Budget

Preparation is key to financial wellness. It doesn’t mean being prepared a month in advance. It means being prepared a year in advance. Which is why I’m writing this post. So you can be prepared for the bleeding wallet season in 2020! The key to financial wellness is having a budget and sticking to it! You can read my full post on creating and sticking to a monthly budget here. It’s a quick read with super easy actionable items to incorporate in your life.

Our budget needed a major overhaul. A few months ago I decided that we weren’t saving enough money and I couldn’t figure out why. Well, I knew why. We had a budget, but didn’t stick to it. In my mind I would compensate for the budget. So if I spent more on groceries I would “take it” from the dining out budget. This was a horrible idea and a signal that I need to reassess everything.

We had a baby at the start of 2019 and didn’t account for that anywhere in our budget. Our grocery bill went up and our eating out went down. Our Target/Amazon (I just signed up for Prime, find out what took me so long here) spend skyrocketed. It made perfect sense though, as I need diapers on demand round the clock.

So we sat down and figured out where all our money was going. In order to do that we have to actually see where it was going. There is no way I could account for every dollar leaving our wallets without physically seeing it. So I invented our very own financial diet to access our spending and reevaluate our monthly budget.

Financial Diet – How It Works

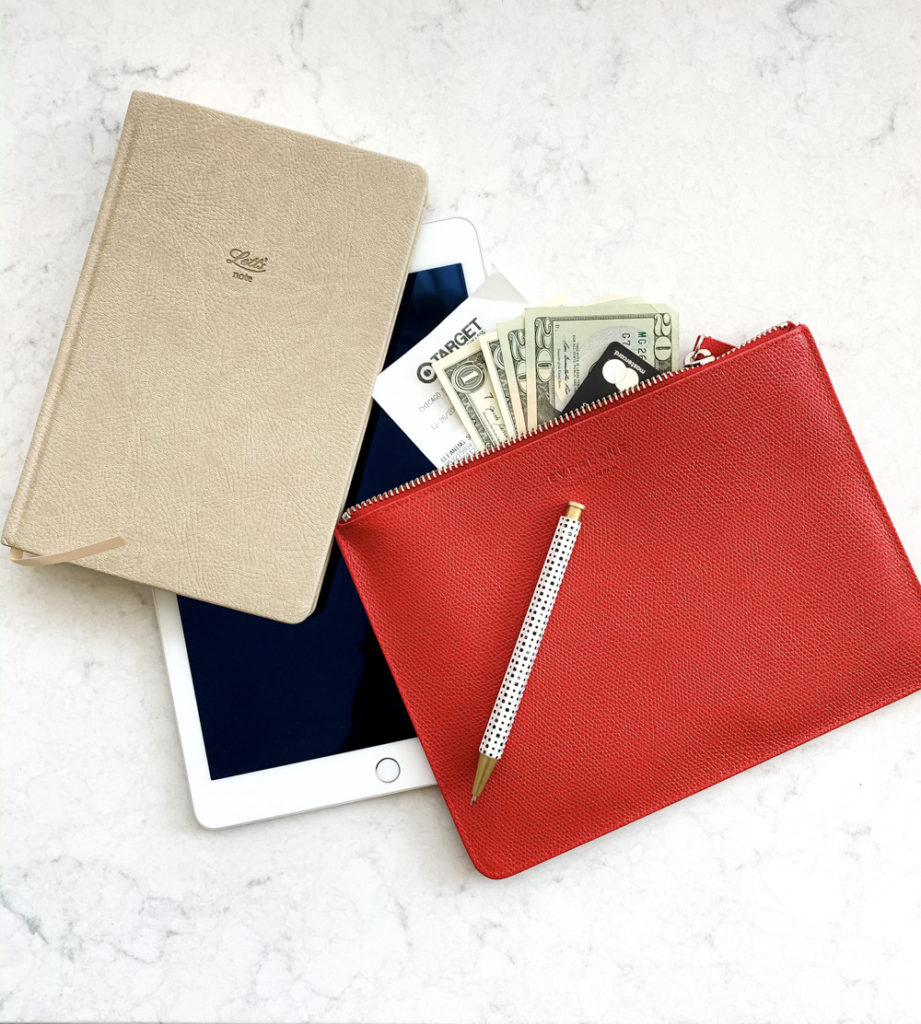

So what exactly is a financial diet? It’s super simple and similar to a food diet. You simply watch what you spend and figure out where your money is going. There is no science around this diet. All you do it write down everything you spend on a sheet of paper. And I mean everything. I wanted to see exactly where our money was going.

Going on a financial diet is pretty easy. You first need to make a conscious decision to go on one, that is the hard part. And you need to go all in on it, no part time diet on this. You need a piece of paper or an excel spreadsheet for tracking purposes and honesty. Every single cent counts and you must track it. Here are a few things you need to do to set up your financial diet for success.

Action Plan

- Create a monthly budget. You can read all about how to create and stick to one in this post here.

- Anytime you spend money you need to write it down. No purchase is too small to track.

- Don’t double count your spending. For example if you take cash out of the bank you can write it down at that time. This way anytime you spend your cash you don’t need to track it. I consider it free spending (silly me!)

- Assign each purchase to a category based on your monthly budget.

- Review your month compared to your budget

At the end of the month, take a look at where you spent your money vs. what you budgeted for. Do you see any themes? I found that we were spending way more money at the grocery store and barely any on eating out. Made perfect sense, we had Lizzie and didn’t go out much any more.

Based on what I saw I adjusted our monthly budget and tried hard to curb my overspending. Curbing the overspending was an easy fix for me personally. I felt guilty when I had to write my spending on that sheet of paper. Very guilty! Part of it was having my spending out there for Mike and I to see. If I spent $150 on clothes we would all see it. And that made me think more about it. Did I really need the items I bought, was I buying simply because I wanted to buy something? The guilt of spending was real.

My financial diet actually worked like magic though, because I truly thought about every dollar I was spending. I was able to assess each item I bought from a need and a want. Now I’m sure you are all thinking well I need food and it’s so expensive. I agree the grocery store is a huge rip off. Earlier this year we switched to shopping at Aldi for our groceries and the savings are amazing! More to come on my love of Aldi later, but switching grocery stores saved my grocery budget!

Falling Off The Wagon And Getting Back On

Now for some hard truth… I fell off the wagon in December. In fact, I stopped writing down my spending and my spending went up. When my credit card bill arrived I was shocked. I knew I was spending more, but was shocked at how quickly a few bucks here and there can add up. The main reason for this inflated bill was me not thinking about my spending.

So starting January 1 I am back on the financial diet. Having my spending in control is just as important to me as being healthy. In life there is health (like medical health) and financial wellness, both are super important to your life.

I am a firm believer that everyone is responsible for their destiny and your financial health is a huge part of that. If you take one thing away from this post it should be that you need to be in control of your finances. Being responsible for your financial well being is so empowering and it’s never too late to take control.

Looking for more motivation? Check out my tips for self motivation in this post here.

Comments

Comments are closed