Buying a home is a huge life event, no matter what age you are. It also doesn’t matter if it’s your first home or fifth home, it’s nerve wracking and exciting all at the same time. I closed on my first home when I was 25. Did I know what I was doing at that age? No. Did I have a ton of help from my parents? Yes.

Looking back, 25 seems so young to own a home, I was a just a kid. And that’s exactly where I came up with the idea, when I was a 15 year old kid. Before we go any further, in full disclosure my first home was a beautiful one bedroom/one bathroom, 850 square foot condo in downtown Chicago. It was my home for 10 years and it was one of my greatest accomplishments in life.

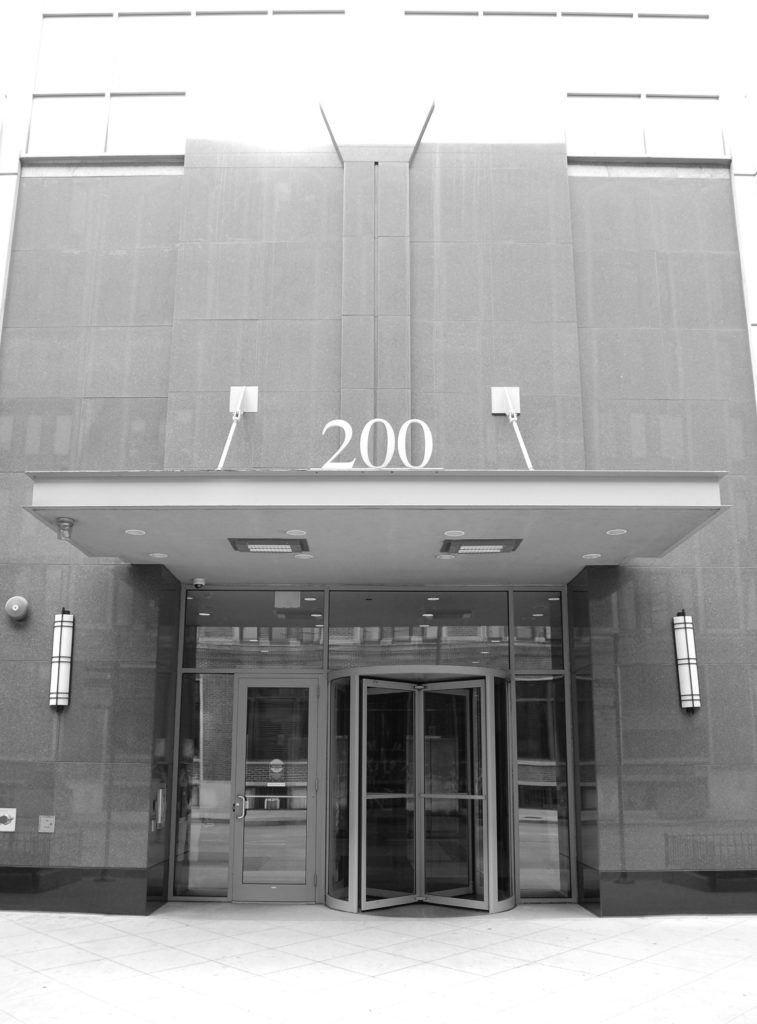

My dream to live in downtown Chicago in a condo started when I was 15 years old. I remember the exact moment I added this item to my dream list. I was with my Mom and Aunt and we were looking at condo units in Chicago for my Aunt to buy. It was a loft style condo with huge ceilings, open concept, great finishes and view of the Sears Tower to die for…I was hooked.

I wanted one and started saving immediately. Also, I took a slip sheet of the condo home with me. It detailed all of the costs associated with buying the condo and from there I started to save. In my mind I thought I needed to come up with the money and pay in full for the condo.

Condo Living

Back then this luxury condo went for $140,000, a price you would never see today. At 15 I lacked the knowledge to know how buying and living in a condo worked. I didn’t know what a mortgage was, I certainly had no idea that I needed a percentage of the cost of the condo as a down payment and I didn’t know about the hidden costs of closing on a home and the costs associated with maintaining it monthly. I learned these things along the way and I will share my insights with you. All I knew at 15 was I had to save money, so that’s what I started to do.

Flash forward 7 years, I graduated college and came back home to live. I got my first adult job in the city and commuted on the train every day to work. I loved it I thought I was a big deal, but something was missing. However, I wanted to live downtown where the action was, I remembered my 15 year-old self saving for that condo and started to kick my savings in high gear. I was lucky my parents let me live at home rent free until I could move out.

It’s actually funny, but my mom had one rule, I could move out as long as I bought a home. Renting wasn’t an option. To most it would sound like a stupid rule, plus I was technically an adult my mom couldn’t tell me what to do. Nonetheless, I listened and took them up on their offer to live with them until I bought something. The majority of my friends moved downtown and rented for years while I was still at home. My parents were great, they let me come and go as I pleased and I had a mutual respect for them and their home. I was blessed I had (and have) a wonderful relationship with my parents, we’ve become great friends.

I started to look for a place when I had a decent amount of money saved. Back when I bought my place, real estate was hot and booming in downtown Chicago. They were building new condos on every corner. My parents helped out and came with me downtown several weekends in a row to look at places. These excursions turned into long days in the car. I was often annoyed and got car sick several times. I finally had enough! When we pulled up to the last building, I was car sick and wanted to go home.

I walked in, looked at the model unit, and said ‘this is it’ about 20 minutes later. (I actually have a talent for making split-second life-altering decisions, however picking a nail polish color is the most agonizing task for me!) Also, I put down a small deposit that day to hold the unit, and discovered I was the third person to buy in the building.

Since the building was new construction there were rules around when down payments were due based on committed buyers in the building. Once they had a certain percentage of committed buyers(technically units sold) I owed 10% of the purchase price. At closing, I would owe the remaining 10% to reach a 20% down payment, in order to avoid paying PMI on the mortgage. From start to finish it took about two years to build the building and for me to move in.

I closed on the condo when I was 25 and was officially a new homeowner at a very young age. I was actually the only one of my friends that owned a home at that time. Talk about a difference of life timelines. Owning a home was always a dream of mine, I’m beyond thrilled that I made that dream come true at such a young age.

Buying My First Home

How does a young adult save for such a massive purchase with crazy student debt and a very low income? First and foremost, I was lucky that my mom had a crazy rule about moving out and buying a home. I also had to thank my 15 year old self for most of it. Once I had this idea in my head, I saved every penny I could. I worked at a snack deck at a local pool as a kid, half of my pay checks I would save the other half I would spend. This is the rule I pretty much lived by well into my first adult job.

At that time I also worked two jobs to save money. From 22 – 29 I worked a 9-5 at a corporate job and spent the weekends working at the Gap. Did I miss out on a few fun things while working all the time? Of course. Did I know that my sacrifice of fun was going to provide me with a great start to life? Yes. In the end was I happy I put in the hard work in my younger years to enjoy my older years? YES!

I lived in this home for 10 years, I made it my own through the years and treasured every moment in it. I had some of my greatest moments in that condo, some of the my greatest life accomplishments as well as some of my worst moments and saddest days. It truly was the house that built me. After I got married and moved out of my condo, I cried so hard about it that Mike didn’t know what to do with me. He thought he should take me back there to live.

I eventually got over the pain of moving out and even laugh about how hard I cried. But that condo will always have a special place in my heart. It doesn’t end there, I ended up keeping the condo and renting it out. You can read about it in my post, Saying “I Do” To Becoming A Landlord. It’s been 2+ years since I left and I haven’t had the heart to go back to it, I want to know the place as I remember when I moved out.

So what did I wish I knew when I bought my first home that I didn’t know? Here is my list of the top six things to know about buying your first home.

- Love your credit score – Your credit score is one of the driving forces that will determine your eligibility for a mortgage. Your credit score starts from the day you sign up for a credit card and will never go away. Your credit score may fluctuate throughout your life, and you are the only person that controls your credit score. Take care of your credit score like you would your health, your credit score is part of your financial wellness.

- Determine your purchase price range before starting to look for a home – Opinions vary, but spending about 28% of your gross income on a monthly payment is a good barometer on where you can comfortably live.

- Know Your Numbers – Be sure you understand what makes up your monthly housing expenses before buying a home. For a condo it typically includes; assessments, taxes and insurance to arrive at your true monthly payment. Assessments alone can make or break your ability to purchase something. Know your numbers!

- Resale Value – Think about selling it the moment you buy it, resale value is important. Things to keep in mind include; location, finishes in the unit and size of the unit.

- Owning a home can be cheaper than renting – I never thought in a million years this would be true. Turns out my monthly mortgage payment was cheaper than most of my friends monthly rents. There is a up front cost in owning a home, but over the long run you own the home and the money you’ve paid is equity in that home.

- You are never too young to buy a home – Age is just a number and shouldn’t stop you from owning a home.

To date, buying my home is one of my biggest accomplishments. Not only is it an American dream, it was my personal dream. If you educate yourself on how to save and buy a home, it’s something that can easily become reality. Have you recently purchased a home or are you thinking of buying one soon? I’d love to hear your story and how you are achieving or have achieved your dream.

Follow me on Instagram for more updates.

Comments

Comments are closed